Solutions & Use Cases

Transforming Trade Finance with Digital Innovation

In the complex world of global trade, paper-based processes slow down transactions, increase risks, and add unnecessary costs. ChainDoX revolutionizes trade finance by digitizing critical trade documents across the XDC Network, ensuring compliance, and enhancing efficiency for banks, exporters, logistics providers, and insurers.

Trade Finance Digitization

Eliminating Paperwork, Enhancing Efficiency

Traditional trade finance is burdened by manual document handling, inefficiencies, and fraud risks. ChainDoX replaces these outdated methods with a secure, digital-first approach, allowing stakeholders to exchange, verify, and process trade documents in real-time across the XDC Network.

- Faster Transactions – Reduce document processing time from weeks to hours.

- Lower Costs – Minimize courier fees, storage expenses, and reconciliation delays.

- Fraud Prevention – Digitally signed, immutable trade documents reduce tampering risks.

Electronic Bills of Lading (eBL)

A Legally-Compliant Digital Revolution

The Bill of Lading (BoL) is the backbone of global trade, but its paper version is prone to loss, forgery, and delays. ChainDoX enables the seamless transition to MLETR-compliant eBLs, ensuring legal recognition across jurisdictions.

- MLETR & ICC Compliance – Legally recognized under international trade laws.

- Faster Cargo Release – No more delays due to missing or delayed paper BoLs.

- Secure & Transparent – Immutable blockchain-backed document storage.

Smart Document Processing

Interoperability & Security at Scale

Handling multiple trade documents across different platforms is complex and inefficient. ChainDoX ensures seamless document exchange, verification, and automation through:

- Interoperable Systems – Connects with banks, logistics firms, and trade finance networks.

- AI-Enabled Verification – Automatically detects inconsistencies and missing information.

- Blockchain-Backed Security – Ensures data integrity and controlled access to documents.

Custom Integrations

Seamless Connectivity Across Trade Ecosystems

ChainDoX is built for scalability and adaptability, allowing businesses to integrate it effortlessly into their existing workflows. Whether you’re a bank, logistics provider, insurer, or enterprise, our platform works within your tech stack.

- ERP & Banking System Integration – Connect with core banking, SWIFT, and ERP platforms.

- APIs for Real-Time Data Exchange – Enable seamless trade data flow.

- Multi-Party Access Control – Ensure only authorized stakeholders can view or modify documents.

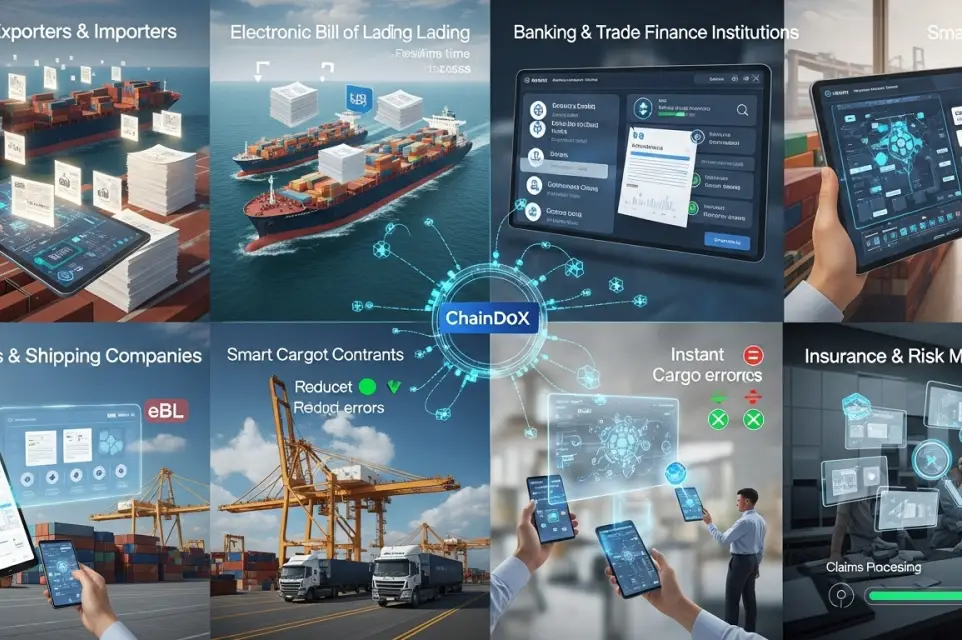

Real-World Use Cases

ChainDoX in Action

- Global Exporters & Importers – Exporters and importers often face delays due to manual document processing, leading to shipment bottlenecks and high administrative costs. With ChainDoX’s electronic Bills of Lading (eBL) and digital trade finance documentation, businesses can eliminate couriering physical documents, reducing turnaround time by 80% and ensuring real-time access to critical trade documents.

- Banking & Trade Finance Institutions – Banks and financial institutions managing Letters of Credit (LCs), guarantees, and invoices struggle with manual verification, compliance checks, and fraud risks. With ChainDoX’s secure, blockchain-based document exchange, banks can digitize LC workflows, reducing processing times from 5 days to a few hours, improving compliance, and minimizing risks associated with document fraud.

- Logistics & Shipping Companies – Shipping carriers, freight forwarders, and port authorities handle paper-based Bills of Lading (BoL), cargo manifests, and certificates, leading to frequent errors and delays. ChainDoX enables a digital-first approach, reducing documentation errors by 90%, ensuring faster cargo release, and improving transparency in the movement of goods across global trade routes.

- Insurance & Risk Mitigation – Trade insurers and risk assessment firms rely on accurate, verified trade documents to process claims, validate transactions, and detect fraud. By integrating ChainDoX’s digital verification and smart contract automation, insurers can automate policy verification, streamline claims processing, and enhance fraud detection mechanisms, ensuring faster settlements and reduced disputes.

Empowering Global Trade with Secure, Paperless Documents

Built on the XDC Network and powered by TradeTrust, ChainDoX helps businesses simplify international trade with legally recognized, blockchain-verified digital documents.